Blood & Ink: Bitcoin & Everything Else.

There is Bitcoin, and there is everything else…

The original promise of Bitcoin was decentralized, immutable, peer-to-peer money.

After 15 years of operation, Bitcoin still does this. Every 10 minutes, tick tock, next block.

It’s gotten stronger at doing all of these: becoming the largest computer network on the planet, developing the lightning network, and an explosion in hash power (security) and node operators (decentralization).

Something happened yesterday that was sad, and frustrating, but important to remember.

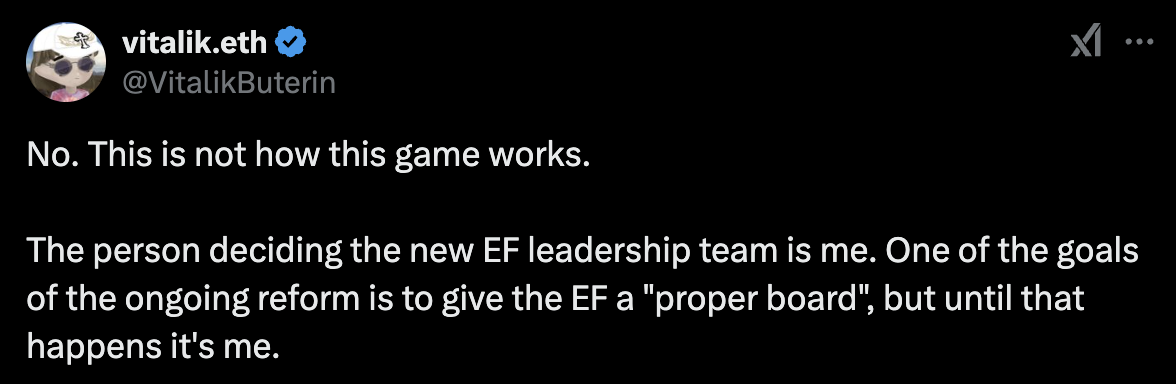

Yesterday, Vitalik (co-founder of Ethereum, the second largest coin by market cap) declared that he had/was taking unilateral control and decision-making authority over the Ethereum Foundation until they sorted out some internal leadership challenges.

Let’s look at that for a moment.

- There is a governing foundation for Ethereum, which has its own leadership and hierarchical structure.

- This Foundation owns the trademark for Ethereum and controls its use policy.

- The Foundation can be—and has been—taken over by a single individual granted sole decision-making authority.

- This governing Foundation was given an astronomical amount of the original Eth token, pre-mined (before public access), and has dumped it consistently on retail investors since Eth started gaining traction.

- The Eth community, led by the Eth Foundation, orchestrated the great ‘rollback’ of the blockchain after the ‘DAO Hack’ almost a decade ago.

Decentralized means there is no center to do any of this. A governing body, a single leader, trademark ownership, insider access — none of this supports the ethos of decentralization. They are antithetical to it.

Not being able to change the history of the blockchain is the definition of what people mean by an ‘immutable ledger’. The Eth community, over a decade ago, showed that Eth was mutable, and they changed it. This led to the Eth Classic split.

To say nothing of Ripple and Solana, the two next largest coins. Developed by companies with classic leadership and equity structures.

It is not my job nor my intent to tell you why decentralization is imperative for sound global money. You can research that yourself. Spoiler: it’s critical.

Bitcoin has no leadership. No decision maker. No foundation. No marketing team. No lawyers. No trademarks. It had no pre-mine and no insider access before release. Nothing to sue. No head to cut off. No organization to manipulate.

I’ve watched for many years as people give janky explanations of why blockchain tech is so important (it’s not), and how these new ‘cryptocurrencies’ use things like decentralization and immutability to give power and authority back to the people.

The thing is… Bitcoin is the only one that meets those criteria.

Satoshi never mentioned blockchain in the original whitepaper. The timechain (his term, not the same idea) is a ‘necessary evil’.

Maybe we’re all just talking about different things, and this is making too big a deal of it. If people are looking for online gambling apps, trading anything with the hopes of it going up, wonderful.

But for those committed to the total separation of money and state, of the birth and adoption of truly global sound money—one thing remains important and clear:

There is Bitcoin, and there is everything else.

Act accordingly,

EB.

No spam, no sharing to third party. Only you and me.